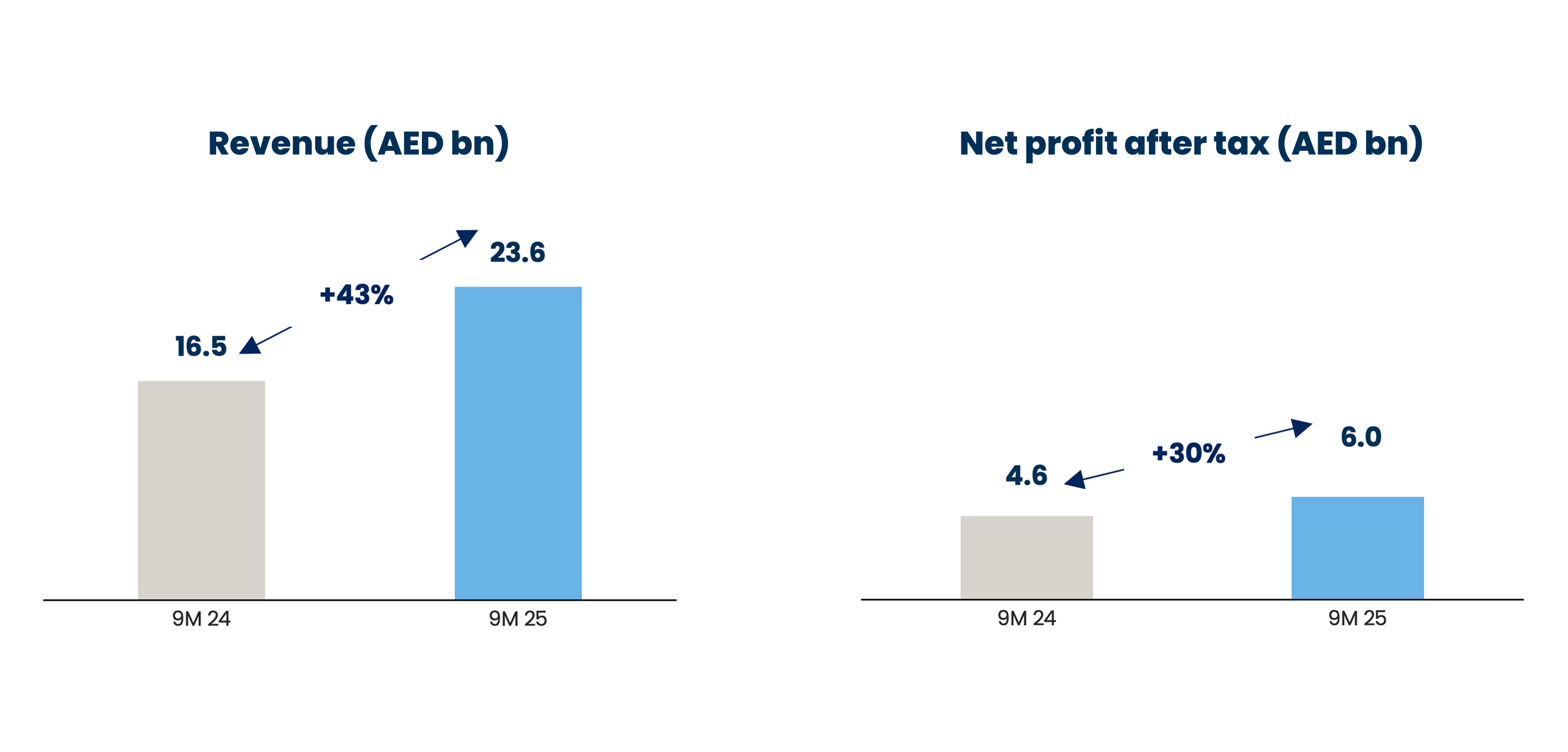

Aldar delivers 30% net profit growth to AED 6 billion in first nine months of 2025 driven by strong performance across all platforms

Q3/9M 2025 Group Highlights

- Nine-month net profit before tax up 43% year-on-year (YoY) to AED 6.8 billion1, while net profit after tax rose 30% YoY to AED 6.0 billion1, driven by broad-based growth across the core business platforms. Earnings per share for the period rose to AED 0.64.

- Strong group development sales of AED 28.5 billion in the nine-month period, up 19% YoY, including UAE sales of AED 26.5 billion.

- Record quarterly UAE sales of AED 9.1 billion in Q3 2025 driven by high demand for existing inventory and three new UAE launches: Fahid Beach Terraces, Rise by Athlon, and Al Deem Townhomes.

- Sustained appeal among international buyers, with UAE sales to overseas and expat resident customers reaching AED 20.4 billion in the first nine months of 2025, 77% of total UAE sales.

- Development revenue backlog rose to an all-time high of AED 66.5 billion, including AED 57.3 billion in the UAE, driving revenue recognition over the next two to three years.

- Aldar Investment’s nine-month adjusted EBITDA rose 17% YoY to AED 2.3 billion driven by high occupancy levels, rising rental rates, and uplift from recent strategic acquisitions, with assets under management at AED 47 billion.

- Commercial and residential assets in Masdar City, acquired at the end of 2024, contributed AED 185 million in adjusted EBITDA in the nine-month period.

- In September, Aldar increased its ownership in Aldar Estates by acquiring a 17.45% stake, bringing its total shareholding to 82.55%.

- Continued progress on develop-to-hold (d-hold) strategy with AED 3.8 billion of new projects, bringing the pipeline to AED 17.6 billion.

- Strong liquidity position supports prudent growth agenda with AED 12.3 billion in free and unrestricted cash, and AED 17.4 billion in committed undrawn bank facilities as at end of September 2025.

- Liquidity was further strengthened through two transactions in Q3 2025, totalling AED 1.8 billion.

1 Starting in 2025, the statutory tax rate for Aldar is 15% based on the Domestic Minimum Top-up Tax (DMTT) introduced by the UAE on 1st January 2025, vs. the 9% statutory tax rate in 2024. The effective tax rate for Aldar was 12.6% in 9M 2025 vs 4.3% in 9M 2024. Therefore, year-on-year comparison of net profit is not on a like-for-like basi

Abu Dhabi, 28 October 2025

| Revenue | Gross Profit | EBITDA | Net Profit (after tax)1 | |

|---|---|---|---|---|

| 9M 2025 |

AED 23.6 bn + 43% YoY |

AED 8.1 bn + 43% YoY |

AED 7.8 bn + 44% YoY |

AED 6.0 bn + 30% YoY |

| Q3 2025 |

AED 8.0 bn + 44% YoY |

AED 2.8 bn + 51% YoY |

AED 2.5 bn + 61% YoY |

AED 1.9 bn + 49% YoY |

1 Starting in 2025, the statutory tax rate for Aldar is 15% based on the Domestic Minimum Top-up Tax (DMTT) introduced by the UAE on 1st January 2025, vs. the 9% statutory tax rate in 2024. The effective tax rate for Aldar was 12.6% in 9M 2025 vs 4.3% in 9M 2024. Therefore, year-on-year comparison of net profit is not on a like-for-like basis

H.E. MOHAMED KHALIFA AL MUBARAK

CHAIRMAN OF ALDAR

“Aldar’s exceptional performance in the first nine months of the year reflects the strength of the UAE’s economic momentum and the scalability of our diversified business model.

As the UAE solidifies its position as a global hub for investment, innovation, and talent, Aldar continues to respond to the country’s thriving demand for high-quality real estate with an unprecedented level of activity across the Group. Our development revenue backlog has reached a record AED 66.5 billion, underscoring the depth of demand for our residential communities, while our AED 17.6 billion develop-to-hold pipeline reflects the scale and breadth of our long-term investment strategy. Together, these platforms reflect Aldar’s pivotal role in shaping the nation’s sustainable urban and economic growth.

With Aldar’s clear strategic vision, capabilities to deliver on our development pipeline and expanded investment portfolio, we continue to capitalise on positive macroeconomic trends and serve as a conduit for the UAE’s ongoing transformation.””

TALAL AL DHIYEBI

GROUP CHIEF EXECUTIVE OFFICER OF ALDAR

“Aldar delivered a record net profit of AED 6.0 billion for the first nine months of 2025, up 30% year-on-year as the strategic investments made across the business in recent years continue to translate into excellent financial performance.

Aldar’s development business achieved a fresh quarterly UAE sales record of AED 9.1 billion in Q3 2025, supported by strong domestic sales and the continued growth of overseas buyers drawn by the UAE’s position as one of the world’s safest and most attractive investment destinations.

The investment properties portfolio continued to expand through rising occupancy, rental uplifts, and value-accretive acquisitions and we are preparing to further satisfy demand across asset classes with a develop-to-hold pipeline that expanded by AED 3.8 billion during the third quarter.

Looking ahead, we remain focused on investing across all our platforms in a disciplined manner to drive sustainable growth, recurring income, and long-term value creation for our shareholders.”

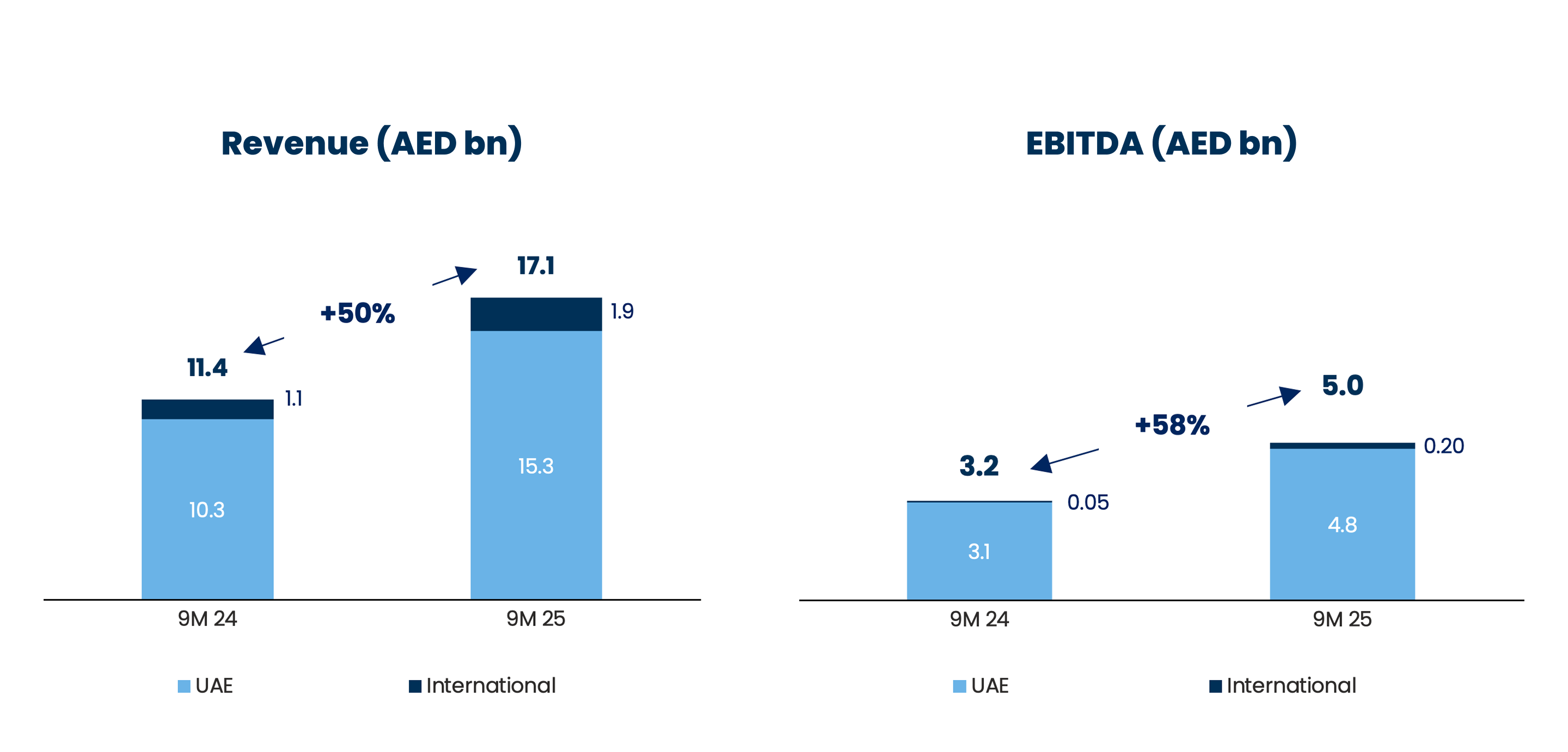

ALDAR DEVELOPMENT

Comprising three segments: Property Development and Sales, focuses on the development and sales of prime properties strategically located in the UAE's most desirable communities. Project Management Services, the dedicated project delivery arm of the Group’s project management businesses; and International, responsible for overseeing property development and sales for both SODIC in Egypt and London Square in the United Kingdom.

| AED billion | 9M 2025 | 9M 2024 | % change | Q3 2025 | Q3 2024 | % change |

|---|---|---|---|---|---|---|

| Revenue | 17.1 | 11.4 | 50% | 5.8 | 3.9 | 51% |

| EBITDA | 5.0 | 3.2 | 58% | 1.7 | 0.9 | 83% |

| Group Sales | 28.5 | 24.0 | 19% | 10.2 | 9.9 | 2% |

| UAE sales | 26.5 | 20.2 | 31% | 9.1 | 7.3 | 24% |

- Aldar Development revenue in Q3 2025 grew to AED 5.8 billion, a 51% increase YoY. Nine-month revenue surged 50% YoY to AED 17.1 billion, with EBITDA increasing 58% to AED 5.0 billion, driven by the successful execution of revenue backlog from new and existing projects.

- Group sales in Q3 2025 increased 2% to AED 10.2 billion maintaining a sustainable run rate. In the first nine months of 2025, Group sales were up to AED 28.5 billion, representing a 19% YoY increase, with both existing inventory and new launches performing healthily, driven by the global sales network and robust domestic demand.

- Group development revenue backlog reached a record level of AED 66.5 billion at the end of September 2025, up from AED 54.6 billion in FY 2024, providing clear visibility on UAE and International revenue over the next two to three years.

- Project management services backlog at the end of September 2025 was AED 82.3 billion, with AED 53.2 billion under construction, reflecting the resilient pipeline of government investment in infrastructure and housing. The platform manages a sizeable portfolio of projects at various stages of development for both the Government of Abu Dhabi and Aldar.

UAE

- Total UAE sales in Q3 2025 increased 24% YoY to a record high of AED 9.1 billion. Nine-month UAE sales totalled AED 26.5 billion, a 31% increase YoY, driven by strong demand for existing developments and eight new launches to the end of September. Aldar launched three projects in Q3 2025: Fahid Beach Terraces, Rise by Athlon, and Al Deem Townhomes.

- UAE sales to overseas and expatriate buyers increased to AED 5.6 billion in Q3 2025 and AED 20.4 billion in the first nine months of 2025, representing 62% and 77% of total UAE sales, respectively.

- UAE revenue backlog at the end of September 2025 stood at a record AED 57.3 billion, up from AED 45.9 billion in FY 2024, with an average duration of 30 months.

- Cash collections in Q3 2025 stood at AED 2.7 billion, taking the nine-month total to AED 10.6 billion as the company pursues timely delivery of projects.

International

SODIC2

- SODIC contributed AED 419 million (EGP 5.5 billion) in revenue in Q3 2025 and AED 711 million (EGP 9.5 billion) in the first nine months of 2025 to Aldar Development.

- SODIC’s sales totalled AED 970 million (EGP 12.4 billion) in Q3 2025 and AED 1.5 billion (EGP 19.6 billion) in the first nine months of 2025. Revenue backlog reached AED 7.2 billion (EGP 94.0 billion) at the end of September 2025, with an average duration of 37 months.

- In October 2025, SODIC announced a partnership with MIDAR to co-develop a mixed-use project within the Mada City development in East Cairo.

London Square (LSQ)3

- London Square’s contribution to Aldar Development’s revenue was AED 434 million (GBP 88 million) in Q3 2025 and AED 1.1 billion (GBP 234 million) in the first nine months of 2025.

- London Square sales in Q3 2025 totalled AED 159 million (GBP 33 million), bringing total nine-month sales to AED 521 million (GBP 106 million). The revenue backlog rose to AED 1.9 billion (GBP 393 million) at the end of September 2025, with an average duration of 33 months.

- London Square launched four new developments in the first nine months of the year, including Nine Elms ‘Ascenta Collection’, Wandsworth Common, Woolwich, and Fifty Brook Green.

2 EGP figures stated at the average exchange rate through quarter end (Q3 2025 EGP/AED = 0.076) as applicable. Spot rate as of 30 September 2025 (EGP/AED = 0.077)

3 GBP figures stated at the average exchange rate through quarter end (Q3 2025 GBP/AED = 4.96) as applicable. Spot rate as of 30 September 2025 (GBP/AED = 4.94)

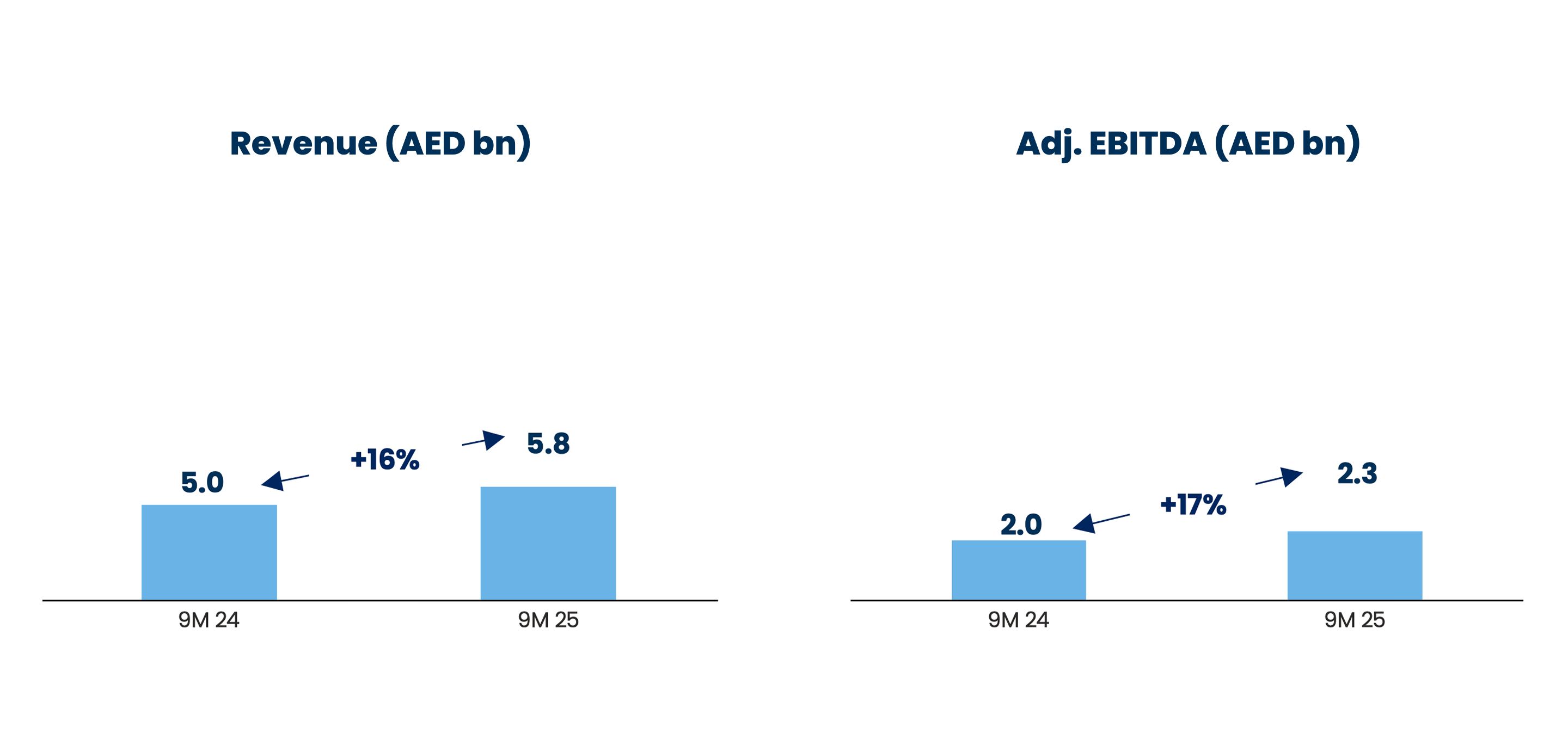

ALDAR INVESTMENT 4

Comprising four main segments representing over AED 47 billion of assets under management (AUM): Investment Properties houses Aldar’s main asset management business comprising prime real estate assets across retail, residential, commercial, and logistics segments. Aldar Hospitality owns a portfolio of hotels as well as leisure assets principally located in Abu Dhabi and Ras Al Khaimah. Aldar Education is the leading private education provider in Abu Dhabi with 27 owned and managed schools primarily across the UAE. Aldar Estates is the region’s largest integrated property and facilities management platform.

| AED billion | 9M 2025 | 9M 2024 | %change | Q3 2025 | Q3 2024 | %change |

|---|---|---|---|---|---|---|

| Revenue | 5.8 | 5.0 | 16% | 2.0 | 1.7 | 15% |

| Adj. EBITDA5 | 2.3 | 2.0 | 17% | 0.8 | 0.7 | 17% |

4 Excludes Pivot.

5 Adjusted for fair value movements (excluding amortization of leasehold assets), reversal of impairments, and one-off gains/losses on acquisitions

- Aldar Investment’s revenue in Q3 2025 grew 15% to AED 2.0 billion while Adj. EBITDA rose 17% YoY to AED 788 million. For the nine-month period, revenue increased 16% to AED 5.8 billion, with the platform’s Adj. EBITDA rising 17% to reach AED 2.3 billion - excluding disposals and divestments, like-for-like nine-month Adj. EBITDA increased 22%. The strong performance was driven by high occupancy and rising rental rates across the investment property portfolio, an uplift from recent strategic acquisitions and a greater contribution from Aldar Estates. Aldar’s develop-to-hold pipeline, valued at AED 17.6 billion, is set to drive further scale, diversification, and earnings growth over the next three years.

- Investment Properties Adj. EBITDA rose 28% YoY to AED 516 million in Q3 2025 and increased 20% YoY to AED 1.5 billion in the first nine months of 2025, supported by portfolio expansion and active asset management, while the strength of the UAE economy has supported demand and rental growth across asset classes. Portfolio occupancy stood at 97% as at end of September.

- Commercial Adj. EBITDA increased 31% YoY to AED 223 million in Q3 2025 and rose 17% YoY to AED 643 million in the nine-month period driven by contributions from Masdar City commercial assets acquired in January 2025, which added AED 103 million, as well as full year contribution from 6 Falak acquired in the second half of 2024. Excluding one-off gains from disposals, nine-month EBITDA rose 31%. Demand for Grade A office space continues to fuel rental growth, with the portfolio at near full occupancy at 99%. In Q3, Aldar exercised its option to acquire Mubadala’s 40% stake in Al Maryah Tower, which has ramped up to 97% occupancy. The platform continues to expand its Grade A supply through execution of the develop-to-hold pipeline, including the recently handed over Yas Place as well as the new Yas Business Park project, which has a gross leasable area (GLA) of 47,500 sqm across four prime office towers and is set for completion in H2 2027.

- Residential Adj. EBITDA rose 19% contributing AED 127 million in Q3 2025 and increased 29% to AED 390 million in the first nine months of 2025 driven by high occupancy of 98% and the addition of fully leased Masdar assets, which contributed AED 81 million, Ongoing growth will be fuelled by the d-hold pipeline including new residential communities in Alreeman and Yas Island, which will offer more than 2,500 homes.

- Retail Q3 Adj. EBITDA increased 27% to AED 143 million and nine-months Adj. EBITDA rose 17% to AED 420 million despite ongoing redevelopment works across parts of the portfolio. Growth was driven by rising rental rates and strong occupancy at 90%. Yas Mall remained the key contributor, with a 12% rise in footfall, 10% rise in tenant sales, and double-digit growth in turnover rent. Occupancy remains high at 97% in the context of ongoing optimisation of retail space to create further value. Jimi Mall, which reopened in September 2025, and retail assets in Noya (100% leased) added further momentum. Future growth will be bolstered by consolidating Yas Mall and The Galleria Luxury Collection under the announced Aldar-Mubadala joint venture, which is expected to close in Q4 2025.

- Commercial Adj. EBITDA increased 31% YoY to AED 223 million in Q3 2025 and rose 17% YoY to AED 643 million in the nine-month period driven by contributions from Masdar City commercial assets acquired in January 2025, which added AED 103 million, as well as full year contribution from 6 Falak acquired in the second half of 2024. Excluding one-off gains from disposals, nine-month EBITDA rose 31%. Demand for Grade A office space continues to fuel rental growth, with the portfolio at near full occupancy at 99%. In Q3, Aldar exercised its option to acquire Mubadala’s 40% stake in Al Maryah Tower, which has ramped up to 97% occupancy. The platform continues to expand its Grade A supply through execution of the develop-to-hold pipeline, including the recently handed over Yas Place as well as the new Yas Business Park project, which has a gross leasable area (GLA) of 47,500 sqm across four prime office towers and is set for completion in H2 2027.

- Logistics Adj. EBITDA increased 116% YoY to AED 32 million in Q3 2025 and 48% YoY to AED 67 million in nine-month 2025, supported by strong occupancy of 98%. Performance was supported by the contribution of the Al Markaz assets and solid leasing at Abu Dhabi Business Hub (ADBH) across warehouses and offices. In the near term, further scale will be driven by the DP World partnership and d-hold pipeline which includes ADBH expansion with additional 175,000 sqm GLA. Long-term growth will be anchored by the Al Falah logistics hub under the Mubadala joint venture.

- The Hospitality portfolio occupancy stood at 69% in the first nine months of 2025, with revenue per available room (RevPAR) increasing 4% and average daily rates (ADR) rising 8% YoY. EBITDA in Q3 2025 increased 10% YoY to AED 40 million and declined 2% YoY to AED 211 million in the nine-month period, reflecting the impact of Aldar’s AED 1.5 billion transformation programme, with several assets partially offline due to the portfolio’s strategic repositioning notably Yas Plaza Hotels, Eastern Mangroves, and Nurai Island. Aldhafra Resort, which opened in Q1 2025, is contributing positively to recurring income and regional diversification.

- Aldar Education Adj. EBITDA increased 1% YoY to AED 212 million in the first nine months of 2025 and declined 9% YoY to AED 85 million in Q3 2025, mainly due to prior one-offs. Excluding one-offs, like-for-like nine-month Adj. EBITDA increased 12% to AED 210 million. Underlying performance was supported by enrolment growth and fee uplifts. Across Aldar Education’s managed and operated schools, total students reached 36,000. Enrolment in operated schools grew 14% YoY in Q3 2025 to 17,900 students, up from 15,750, driven by organic growth as well as the addition of new greenfield schools. The Yasmina American School in Khalifa City and the new Muna British School campus - Abu Dhabi’s first Estidama 5-Pearl rated school – on Saadiyat Island are now open.

- Aldar Estates Adj. EBITDA delivered strong earnings growth, with adjusted EBITDA rising 26% to AED 121 million in Q3 2025 and 25% to AED 313 million for the nine-month period. Performance was driven by broad-based growth across property management, facilities management, and integrated community services, supported by new contract wins worth almost AED 250 million during the period. The platform continued to expand in Q3 2025 with the increase of Aldar’s ownership in Aldar Estates to 82.55% and the acquisition of Hansa Energy.

Group & Corporate Updates

- In Q3, Aldar further enhanced its liquidity position by an additional AED 1.8 billion through two transactions. Aldar Investment Properties successfully raised USD 290 million through taps on its existing green sukuks maturing in 2034 and 2035, priced at a spread of 87 bps over the benchmark US Treasury yield, representing the tightest spread achieved by Aldar. In parallel, London Square secured a GBP 150 million senior unsecured conventional revolving credit facility.

- Aldar’s Group Net Promoter Score (NPS) rose 20% year-on-year in Q3, reflecting sustained customer confidence and satisfaction across its core businesses.

- World of Aldar, the Group’s immersive virtual property platform, saw active users surge 62% year-on-year to over 166,000, reflecting the strong shift toward digital-first engagement in real estate.

- Darna Rewards continued its strong momentum, with membership approaching 200,000 and active users rising 82% year-on-year. Card linkages grew 51%, supporting AED 500 million in sales during the period.

- The Digital Retail Tenant Experience platform launched, providing self-service leasing and real-time sales insights to retail partners. Adoption is ramping up, with 25% of tenants already onboarded, reducing manual processes by 10% and driving higher operational efficiency.

- The Living In platform introduced new digital service requests and community features, lifting digital interactions by 20% quarter-on-quarter and advancing Aldar’s vision of a fully connected residential ecosystem.

ESG Highlights

As one of the UAE’s leading real estate developers, Aldar has a duty to uphold best practice international ESG standards. ESG is a core pillar of the company’s long-term growth strategy, with strong governance and responsible environmental and social impact integrated into its investment processes and business decisions. Highlights of Aldar’s recent ESG activities include:

- Aldar deepened its partnership with Dubai Cares to advance access to quality education, completing the first of two planned school renovation projects. In parallel, the annual ‘Back to School’ initiative supported 10,000 students from low-income families with essential learning materials.

- Aldar has recruited 1,430 UAE nationals since 2021, outperforming its NAFIS commitment to hire 1,000 Emiratis by 2026. The company was recently recognised by NAFIS for its exceptional efforts in Emiratisation, with UAE nationals now representing 44.3% of the Group’s employee base.

- Aldar achieved an Energy Use Intensity (EUI) improvement of 31% by design against the ASHRAE 2007 baseline. The company has also reduced embodied carbon in construction materials by 29% compared to business-as-usual levels and recycled 86% of construction and demolition waste.

- Aldar’s Thrive Scholarship Programme has now enrolled 67 students since its launch in 2022, offering quality education to students from low-income households, with 16% of beneficiaries being People of Determination.