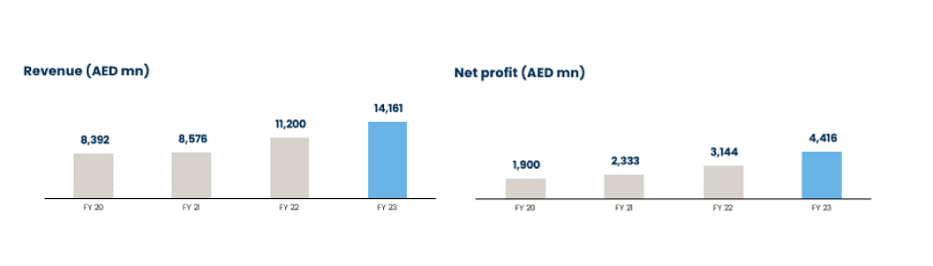

Record development sales and expanded investment portfolio drive Aldar’s 2023 net profit up 40% to AED 4.4 billion

FY 2023 Group Highlights

- Highest-ever quarterly development sales of AED 8.5 billion in Q4, with full-year sales hitting a record AED 27.9 billion.

- Development revenue backlog doubled to AED 36.8 billion, providing strong income visibility over the next 2-3 years.

- 14 new project launches with successful entry into Dubai and Ras Al Khaimah markets complementing dominant position in Abu Dhabi.

- Strong demand from end-users and investors, with overseas and resident expat buyers accounting for 66% (AED 16 billion) of UAE sales.

- Aldar Investment recorded 40% revenue growth driven by recent acquisitions, active asset management, and strong operational performance across the business.

- International expansion strategy activated through the acquisition of UK developer London Square, investment in European real estate private credit, and direct investments in European logistics and self-storage assets.

- Aldar is well positioned for further expansion, centred on its home market, with a strong liquidity position of AED 2.9 billion in free cash and AED 7.5 billion in undrawn credit facilities.

- AED 5 billion pipeline of ‘develop-to-hold’ assets across core segments and AED 1 billion investment in logistics set to bolster recurring-income streams and long-term capital appreciation.

- Recommended dividend of AED 0.17 per share represents a total payout of AED 1.3 billion in 2023. 10-year dividend CAGR of 9% demonstrates Aldar’s solid track record of delivering sustainable shareholder value.

| Revenue | Gross Profit | EBITDA | Net Profit | |

|---|---|---|---|---|

| Q4 2023 |

AED 4.4 bn + 40% YoY |

AED 1.6bn + 29% YoY |

AED 1.6 bn + 42% YoY |

AED 1.4 bn + 39% YoY |

| FY 2023 |

AED 14.2 bn + 26% YoY |

AED 5.6 bn + 24% YoY |

AED 5.1 bn + 39% YoY |

AED 4.4 bn + 40% YoY |

H.E. MOHAMED KHALIFA AL MUBARAK

CHAIRMAN OF ALDAR

“The strength of the UAE economy, driven by a thriving business-friendly environment, continues to provide conducive conditions for the real estate market. Leveraging its unique platform, Aldar accelerated its transformative growth trajectory in 2023 to deliver remarkable earnings growth, with an intensive programme of new development launches and the enhanced performance of its recurring income portfolio. "

“By further capitalising on secular trends and the transition to a net zero economy, we look forward to continuing to play a central role in the UAE’s dynamic socio-economic development and the growth of its real estate sector in the coming years.”

TALAL AL DHIYEBI

GROUP CHIEF EXECUTIVE OFFICER OF ALDAR

“Aldar is transforming into a world-class industry heavyweight, operating at a significantly elevated scale. Over the past five years, our business has grown significantly. Development sales in 2023 surged tenfold compared to 2018, the gross asset value of our investment property portfolio grew by more than fifty percent, and net profit more than doubled, reaching AED 4.4 billion.

“This tremendous performance over a short timeframe has been witnessed across our core businesses, where we have delivered significant geographic and sector diversification and scale and enhanced long-term resilience. The strength, agility, and scale of our platform will allow Aldar to capitalise on new opportunities to continue driving long-term sustainable growth and shareholder value.”

ALDAR DEVELOPMENT

| Aldar Development AED million |

Q4 2023 | Q4 2022 | % change | FY 2023 | FY 2022 | % change |

|---|---|---|---|---|---|---|

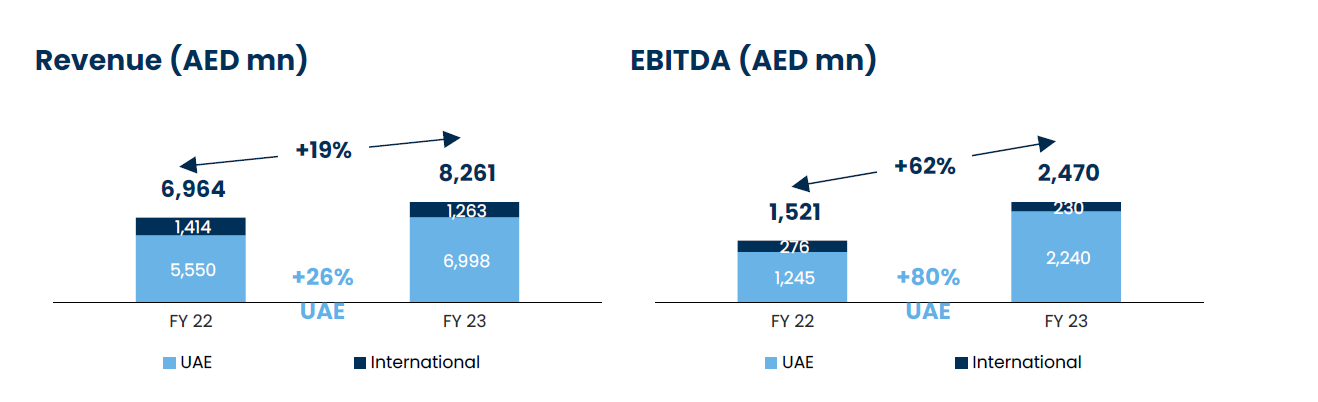

| Revenue | 2,440 | 1,784 | 37% | 8,261 | 6,964 | 19% |

| EBITDA | 612 | 175 | 251% | 2,470 | 1,521 | 62% |

| Group Sales | 8,536 | 5,175 | 65% | 27,931 | 14,414 | 94% |

| UAE sales | 7,241 | 3,790 | 91% | 24,281 | 10,989 | 121% |

- Aldar Development’s revenue in Q4 2023 increased 37% YoY to AED 2.4 billion driven by project completions, buoyant off-plan sales, and ongoing execution of revenue backlog, with full-year revenue increasing 19% YoY to AED 8.3 billion.

- Group sales in Q4 2023 reached AED 8.5 billion, a 65% increase from the same period last year, marking Aldar’s highest-ever quarterly sales. Group sales for the full year reached a record AED 27.9 billion, up 94% YoY driven by strong demand from overseas and expat buyers for newly launched properties in the UAE, as well as Aldar's strategic entry into Dubai, Ras Al Khaimah, and the United Kingdom.

- Group revenue backlog reached a record AED 36.8 billion as at the end of 2023, providing strong visibility on revenue across the UAE, Egypt, and UK operations over the next 2-3 years.

- Project management services backlog of AED 81.9 billion, with AED 32 billion currently under construction. In 2023, new awards amounted to AED 30 billion, with AED 26 billion secured in Q4 2023, primarily driven by government housing, infrastructure, and road improvement projects, as well as new government schools.

UAE

- Total UAE sales for Q4 2023 was up 91% YoY, reaching an all-time high of AED 7.2 billion, while full-year UAE sales increased 121% YoY to a record AED 24.3 billion. This was driven by strong demand for both new and existing developments in Abu Dhabi, as well as the successful debut offerings launched in Dubai and Ras Al Khaimah.

- UAE sales to overseas and expat buyers reached a record AED 16 billion (66% of total UAE sales) over the course of the year, underscoring Abu Dhabi’s prominence as a premier investment destination and long-term home. Sales to overseas and resident expat buyers account for 28% and 38% of the total UAE sales respectively.

- UAE revenue backlog of AED 29.1 billion, increased 141% YoY with an average duration of 29 months. Q4 cash collections stood at AED 1.7 billion while full year cash collections stood at AED 6.2 billion.

International

- SODIC contributed AED 616 million (EGP 5.2 billion) in revenue and AED 152 million (EGP 1.3 billion) of EBITDA to Aldar Development in Q4 2023. Full-year revenue stood at AED 1.2 billion (EGP 10 billion), with EBITDA at AED 227 million (EGP 1.9 billion).

- SODIC’s sales were AED 1.3 billion (EGP 10.7 billion) in Q4 2023 and AED 3.6 billion (EGP 30.5 billion)1 for the full year 2023. Revenue backlog was AED 5.9 billion (EGP 49.7 billion) as at the end of 2023, with an average duration of 36 months, providing strong earnings visibility on revenue over the next 2 years.

- SODIC continues to maintain a strong liquidity position with total cash and cash equivalents amounting to AED 221 million (EGP 1.9 billion1).

Key highlights

- Strategic landbank expansion with the acquisition of Al Fahid Island, a prime plot of land between Yas Island and Saadiyat Island.Launched a number of new projects in Abu Dhabi including The Sustainable City Yas Island, Manarat Living, Reeman Living, Fay Al Reeman II, The Source, The Source II, AlKaser, and Gardenia Bay in Abu Dhabi.

- Partnered with Dubai Holding to develop three communities in Dubai, the first of which – ‘Haven by Aldar’ – was launched within a year of the JV signing.

- Partnered with Abu Dhabi Housing Authority to launch Balghaiylam, a new residential development located northeast of Yas Island, with a gross development value of AED 8 billion.

- Launched Nobu branded residences on Saadiyat Island in Abu Dhabi and partnered with Nikki Beach to develop a luxury beachfront residential project on Al Marjan Island in Ras Al Khaimah.

- First international expansion beyond the MENA region with the acquisition of UK-based developer London Square.

- Awarded 49 contracts, totalling AED 22 billion, for a series of projects, including infrastructure, residential, commercial, and mixed-use developments across Abu Dhabi in 2023.

ALDAR INVESTMENT 2

| Aldar Investment3 AED million |

Q4 2023 | Q4 2022 | % change | FY 2023 | FY 2022 | % change |

|---|---|---|---|---|---|---|

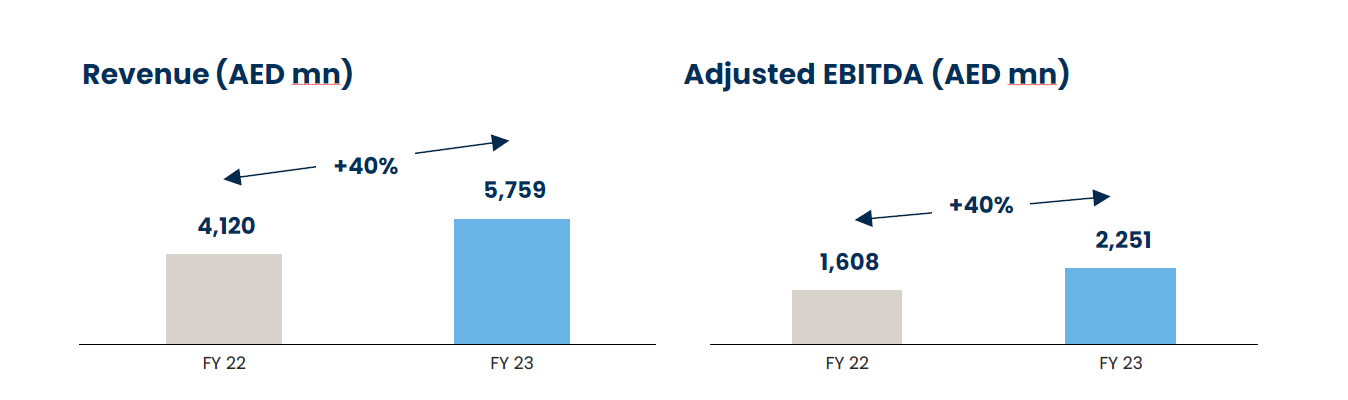

| Revenue | 1,754 | 1,320 | 33% | 5,759 | 4,120 | 40% |

| Adj. EBITDA | 635 | 443 | 43% | 2,251 | 1,608 | 40% |

- Aldar Investment’s Adj. EBITDA rose 43% to AED 635 million in Q4 2023 and up 40% in FY 2023 to AED 2.3 billion driven by strong operational performance across all business segments and outperformance of 2022 acquisitions and further capital deployed in 2023.

- Aldar’s ongoing expansion efforts not only increased the assets under management from AED 32 billion in the previous year to AED 37 billion, but also further diversified the portfolio across various asset classes and geographies. This includes acquisitions to bolster the Aldar Logistics, Aldar Estates, and Aldar Education businesses as well as venturing into alternative investments, including real estate private credit and direct investments into logistics and self-storage assets.

- Investment Properties Adj. EBITDA in Q4 2023 increased 22% YoY to AED 343 million, while full-year Adj. EBITDA rose 25% to AED 1.5 billion. This strong performance was primarily driven by higher occupancy levels across the portfolio, as well as meaningful contributions from 2022 acquisitions which continue to positively impact the bottom line. Occupancy across the portfolio was 93% as a result of proactive asset management.

- Residential Q4 2023 Adj. EBITDA increased 9% YoY to AED 91 million, with occupancy rate reaching 94% on the back of substantial demand for Aldar’s high-quality residential properties. Full-year Adj. EBITDA rose 14% to AED 449 million driven by strong operational performance of the portfolio and a one-off early lease termination fee for a residential bulk lease agreement.

- Retail Q4 2023 Adj. EBITDA increased 8% YoY to AED 97 million, with a full-year increase of 2% YoY to AED 443 million and a solid 91% portfolio occupancy rate. The portfolio delivered solid performance, despite the ongoing redevelopment of Al Jimi Mall and Al Hamra Mall. Yas Mall continues to attract signature brands and shoppers, resulting in a 97% occupancy rate, a 22% rise in tenant sales, and a 30% increase in footfall. Aldar aims to replicate this success with the repositioning of Al Jimi and Al Hamra malls.

- Commercial Q4 2023 Adj. EBITDA increased 51% YoY to AED 147 million, while full-year Adj. EBITDA increased 73% YoY to AED 582 million. The strong performance was primarily driven by the 2022 acquisition of ADGM towers, as well as the strong demand from both GREs and international corporates, resulting in a 95% occupancy rate across the portfolio. The four ADGM office towers achieved robust occupancy at 96% while HQ and International Towers witnessed occupancy of 93% and 99% respectively. Meanwhile, Al Maryah Tower will open in Q1 2024 with a 65% pre-lease rate.

- Aldar Logistics Q4 2023 Adj. EBITDA increased 13% YoY to AED 15 million while full-year Adj. EBITDA increased 33% YoY to AED 52 million, with occupancy of 93%.

- Hospitality Q4 2023 Adj. EBITDA increased 19% YoY to AED 159 million while full-year Adj. EBITDA rose 84% YoY to AED 383 million driven by positive contributions from recent acquisitions and higher average daily rates (ADR) across the portfolio. Overall occupancy stood at 70% with ADRs rising by 23% YoY.

- Aldar Education Q4 2023 Adj. EBITDA witnessed a 28% YoY increase to AED 54 million while full-year Adj. EBITDA increased 27% YoY to AED 195 million. Student enrolments within operated schools grew 25% YoY to over 14,000 students driven by new school additions. Including managed schools, the total student body now exceeds 38,000 across 31 schools comprising 11 owned-and-operated schools and 20 managed schools.

- Aldar Estates witnessed a 150% YoY increase in Q4 2023 Adj. EBITDA to AED 85 million, and a 117% rise in full-year Adj. EBITDA to AED 199 million driven by recent acquisitions that significantly scaled up the property and facilities management services. The business has undergone substantial transformation through strategic mergers and acquisitions, effectively doubling the portfolio’s size and firmly establishing itself as the region’s largest integrated property and facilities management platform.

Key highlights

- AED 5 billion “develop-to-hold” pipeline announced across commercial, retail, and hospitality segments as well as AED 1 billion investment to expand its logistics portfolio.

- Expanded its investment in Aldar Education by injecting an additional AED 350 million, bringing the total commitment to AED 1.35 billion. This includes the acquisition of Kent College Dubai and Virginia International Private School, as well as the establishment of four upcoming schools: the new Yasmina British Academy, Noya British Academy, Cranleigh Bahrain, all scheduled to open in the academic year 24/25, and a new school in Saadiyat Lagoons set to come online in the academic year 25/26.

- Broadened the Aldar Estates portfolio through a strategic merger with Eltizam Asset Management and acquisitions of FAB Properties and Basatin Landscaping.

- Invested in European private real estate credit through a partnership with Ares Management and Mubadala.

- Partnered with Carlyle to invest in logistics assets in the United Kingdom and a portfolio of self-storage facilities in Europe.

ESG Highlights

As one of the UAE’s leading real estate developers, Aldar has a duty to uphold best practice international ESG standards. ESG is a core pillar of the company’s long-term growth strategy, with strong governance and responsible environmental and social impact integrated into its investment processes and business decisions. Highlights of Aldar’s recent ESG activities include:

- Aldar raised USD 500 million through an inaugural green sukuk, which forms part of a USD 2 billion programme aligned with Aldar's Green Finance Framework. In addition, the company has secured AED 2.5 billion in sustainability-linked loans as part of a broader AED 4.8 billion in debt funding in 2023.

- Aldar recirculated over AED 10.5 billion in the local economy through the National In Country Value (ICV) programme in 2023, awarding contracts to local contractors and suppliers.

- Aldar achieved 47 points on the Dow Jones Sustainability Index (DJSI), maintaining its top spot in the GCC, and within the top quartile of the 299 global real estate companies assessed. Aldar also maintained a low-risk score of 15.9 on Sustainalytics Risk Index and continued to hold its BBB rating in MSCI.

- During COP28, Aldar announced its joint venture with Tadweer and Polygreen to launch Ecoloop, a first-of-its-kind circular model, to divert and transform waste across Aldar’s owned and managed assets. The company also partnered with Yellow Door Energy to provide solar energy across 45 of Aldar’s core assets and signed an agreement with Johnson’s Controls to launch Abu Dhabi’s first ‘cooling as a service’ project.

- Aldar has completed a LEED gap assessment for its existing portfolio with plans to uplift more than 20 assets to LEED Gold and Platinum standards by H2 2024.

- Aldar has made significant progress toward its commitment to create job opportunities for 1,000 UAE nationals by 2026, with a current achievement of 66%. Through the NAFIS program, the company hired 349 UAE nationals in 2023, bringing the total to 661 since its launch in September 2021. UAE nationals now constitute 42% of the Group's workforce.